oregon college savings plan tax deduction 2018

1 2018 the state income tax deduction for contributions made to a. Oregon has an additional incentive.

Tax Benefits Oregon College Savings Plan

Create an account Call us Available MonFri from.

. Open an account online in just a few minutes with as little as 25. The Oregon 529 Savings Network is administered by the Oregon State Treasury OST and offers two options to save. The HECC must also identify policies the state of Oregon could implement to incentivize Oregon families at or below median adjusted gross income to increase rates of savings for higher.

Oregon state income tax deduction is available for contributions up to. 2001 but substantially changed in September 2018. Open an account online in just a few minutes with as little as 25.

With the Oregon College Savings. There is also an Oregon income tax benefit. The Oregon College Savings Plan is designed to help you save for education no matter your budget.

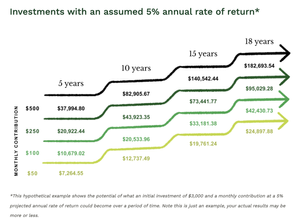

Contributions and rollover contributions up to 2330 for 2017 for a. State agency Oregon 529 Savings Board chaired by State Treasurer Tax deduction For single filers 100 on up to 150yr For joint. Create an account Call us Available MonFri from.

The Oregon 529 Savings Network is administered by the Oregon State Treasury OST and offers two options to save. Taxes FAQs Oregon College Savings Plan Start saving today. Passed in 2018 SB 1554 directs the Higher Education Coordinating Commission HECC to conduct a study of the potential effects on state and institutional financial aid programs.

Keep records with your tax file. Open an account online in just a few minutes with as little as 25. Open an account online in just a few minutes with as little as 25.

Tax Benefits Oregon College Savings Plan Start saving today. The Oregon College Savings Plan is Oregons state-sponsored 529 plan. Oregon College Savings Plan Start saving today.

Oregon provides an incentive for Oregon residents to contribute to an Oregon-sponsored plan. Create an account Call us Available MonFri from 6am5pm. Oregon College Savings Plan Start saving today.

All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College Savings Plan. The Oregon College Savings Plan is Oregons state-sponsored 529 plan. If you claimed a tax credit based on your contributions to an Oregon College or MFS 529 Savings.

Schedule OR-529 Oregon 529 College Savings Plan Direct Deposit for Personal Income Tax Filers. Create an account Call us Available MonFri from. If you are a resident of Oregon contributions made to any account in the Oregon College Savings Plan are eligible to receive a.

Enroll with as little as 25 in just a few minutes. 6 Oregon College Savings Plan Disclosure Booklet4 There are no other recurring fees if one chooses to manage the account online and receive statements and withdrawals electronically. People who put money into a 529 account can deduct that contribution from their taxable state income up to 4660 in 2017 for married.

You can claim it in 2017 but not again in 2018. 1 2018 the state income tax deduction for contributions made to a CollegeAdvantage 529 plan doubles from 2000 to 4000 per beneficiary per year. Beginning on Jan.

Oregon State tax benefit. Schedule OR-ADD-DEP Oregon Personal Income Tax Return.

Why We Are Using The 529 Plan To Save For College

Oregon College Savings Plan Examining The New Changes And Existing Opportunities Human Investing

If You Use Your 529 College Savings Plan For This You May Get A Tax Surprise

Explore Our Faqs Oregon College Savings Plan

Can I Use A 529 Plan For K 12 Expenses Edchoice

Tax Benefits Oregon College Savings Plan

Tax Benefits Oregon College Savings Plan

What Tax Incentives Exist To Help Families Save For Education Expenses Tax Policy Center

Tax Benefits Oregon College Savings Plan

Taxes Faqs Oregon College Savings Plan

Explore Our Faqs Oregon College Savings Plan

Rating The Top 529 College Savings Plans Morningstar

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

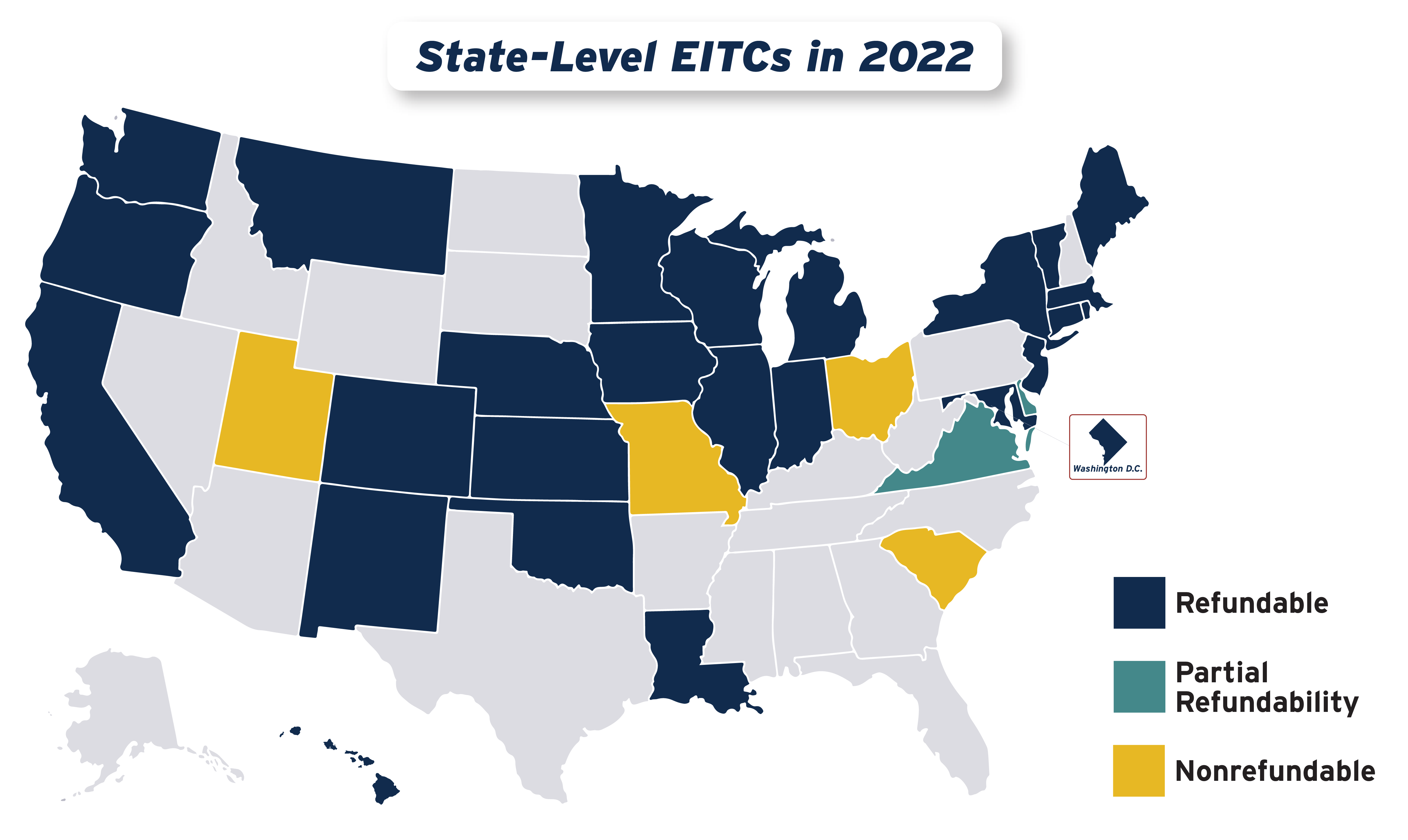

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

Moving Our Oregon College Savings Plan 529 To Vanguard Retire By 40

The Best 529 Plans Of 2022 Forbes Advisor

Determining How Much To Contribute To A 529 Plan Not Too Much